Breaking Down Credit Scores

Last Updated

July 21, 2025

Written By

Family First FCU

If you’ve ever applied for a loan, credit card, or even rented an apartment, chances are your credit score came into play. But what exactly is a credit score, how is it calculated, and most importantly, how can you improve it?

Let’s break it down.

What is a Credit Score?

A credit score is a three-digit number that ranges from 300 to 850, with a higher score indicating stronger credit health. This number is a snapshot of your creditworthiness. Essentially, it tells lenders how likely you are to repay borrowed money based on your past financial behavior. The score is based on your credit history, including how much debt you carry, how reliably you pay your bills, and more.

Who has a Credit Score?

If you’ve opened a credit card, student loan, or car loan – even if you’re listed as an authorized user on someone else’s credit card – you will likely have a credit score. A score is typically generated for you within a month of the account opening. Credit scores play a huge role in financial wellbeing and in todays world, having a strong score has basically become a necessity when it comes to most major purchases, like a new car or your first home. Yet, 1 in 10 people still don’t know their credit score, and 1 in 5 don’t know how to check it.

Why Credit Scores Matter

Your credit score can directly impact your financial future. A higher score can unlock:

- Lower interest rates on loans and credit cards

- Better loan terms

- Higher chances of approval for renting, utilities, and even employment in some industries

Better Score → Better Rates → More Savings

What Determines Your Credit Score?

Here’s a look at how credit reporting agencies typically weigh different factors in your score:

🟦 40% – Payment History

This is the MOST important factor. On-time payments = healthy credit.

🟩 23% – Credit Usage

Also referred to as credit utilization, this is the ratio of your current credit card balances to your total credit limits. Lower is better. Aim for under 30%. (insert example – If your credit limit is $1,000 try to maintain a balance of $300 or less)

🟨 21% – Credit Age

The longer your accounts have been open, the better. This shows financial maturity.

🟧 11% – Account Mix

A good mix of credit types, like installment loans (ex. personal, auto) and revolving credit (ex. Credit card, Moneyline) is a plus.

🟥 5% – Credit Inquiries

Having too many recent applications for credit can lower your score temporarily.

How to Check Your Credit Score & Report

Check your credit report for free within your digital banking dashboard through the Credit Score feature. If your credit score does not appear on your report, it’s available through the Credit Score feature in online banking.

Tips to Build and Boost Your Score

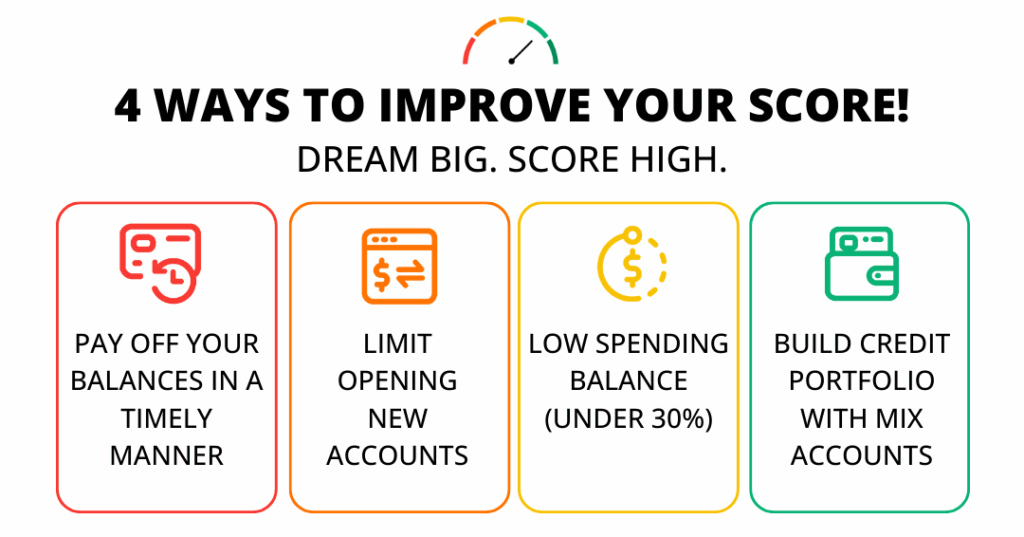

Want to raise your score or keep it in good standing? Try these credit-building tips:

- Pay your bills on time, even one missed payment can cause your score to drop

- Keep balances low, ideally below 30% of your credit limit

- Don’t close old accounts, especially if they’re in good standing

- Limit new credit applications unless truly needed

- Monitor your credit report for errors and report them quickly

Try the Score Simulator

Curious how paying off a balance or opening a new card might affect your score? The Credit Score Simulator lets you test financial “what-ifs” without impacting your real score. You can simulate actions like:

- Paying down credit cards

- Missing a payment

- Opening a new loan

It’s a free, safe way to make smarter financial decisions and see potential impacts before you act.

Credit Confidence Starts with Understanding

Credit scores don’t have to be confusing. By knowing what affects your score and taking a few smart steps, you can build a healthier financial future and potentially save thousands on interest and fees in the long run.

Log in to your digital banking and check out the Credit Score feature today to get started on your path to credit confidence!