Commercial Real Estate Financing Basics

Last Updated

March 6, 2020

How to Secure Your First Commercial Real Estate Loan

Are you ready to dive into the world of commercial real estate investing? A lucrative and successful business for many, we encourage you to explore if it’s the right investment activity for you. Before you enter this complex market, we’ve gathered some key commercial real estate financing basics for you to consider.

What classifies as a commercial property?

One of the first steps is understanding what classifies a property as commercial vs residential. Properties are considered commercial if they produce income and are used for business purposes only. Some examples include retail buildings, office space, and warehouses.

Today, many are choosing to invest in commercial properties due to income potential, limited hours of operation, and more flexibility. Not to mention, commercial properties generally have an annual return off the purchase price between 6% and 12%.

What financing options are available for commercial real estate?

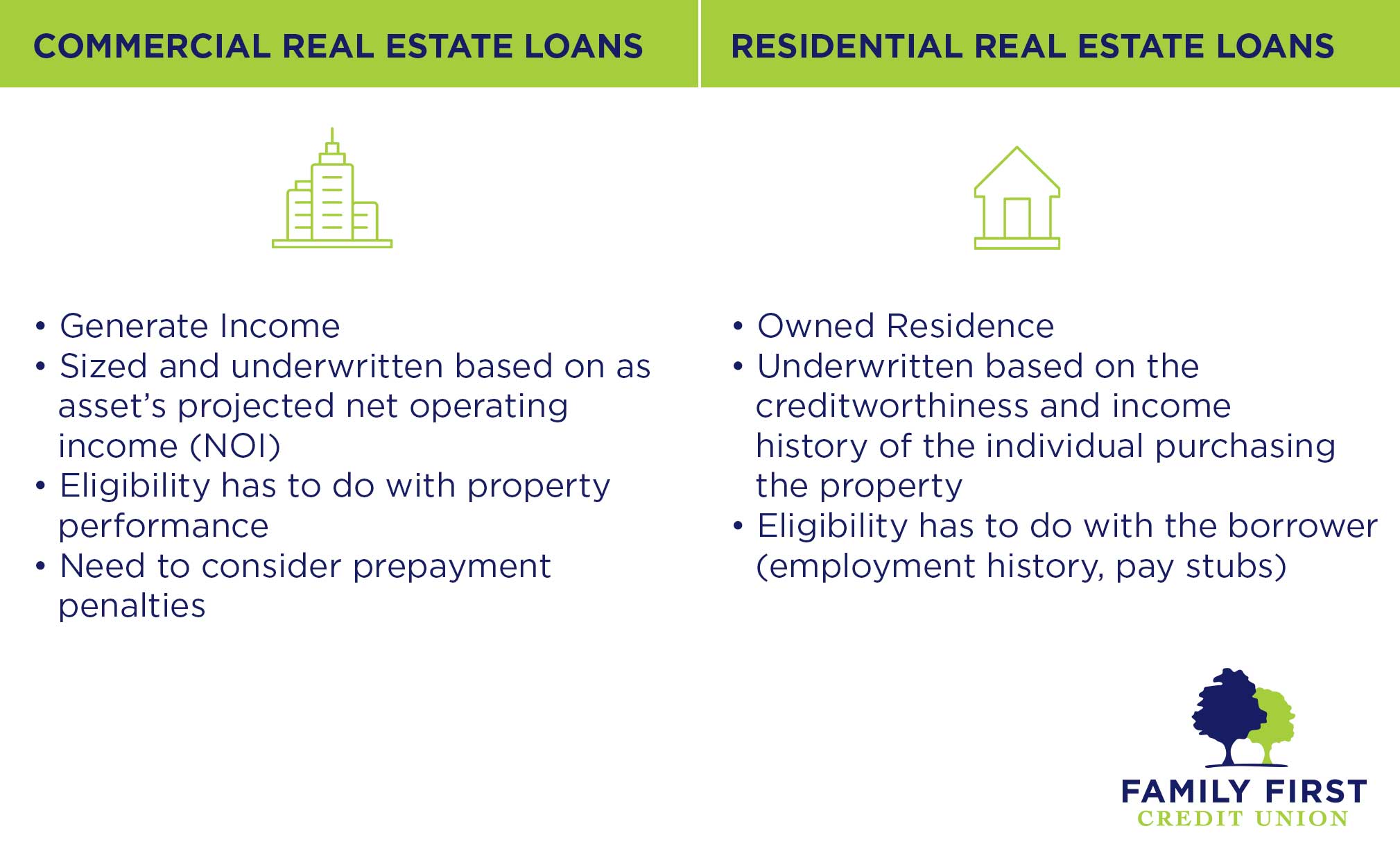

Commercial property loans are mortgages delegated uniquely to properties through which businesses operate. Before you explore your loan options, you should understand the difference between commercial and residential loans.

When it comes to selecting the commercial loan, you should understand what types of options are out there. Here are some of the most common options:

- SBA 7A Loan – The U.S. Small Business Administration (SBA) offers some of the least expensive loans for investing in commercial real estate, and guarantees repayment of a portion of the loan. SBA-backed loans help the borrower by increasing credibility and reducing risk for the lender.

- SBA 504 Loan – he 504 loan program works best for larger investment projects, such as those valued over $1 million. The investor must put down 10 percent of the loan amount as the down payment, while 40 percent of the loan is sourced from an SBA Certified Development Company

- Conventional Bank Loan – A majority of commercial real estate loans are made by banks, who prefer to lend to entities with strong credit histories. Individuals with a credit score of at least 660 and are working with mid- to large-sized projects will find conventional bank loans as a viable commercial real estate financing option.

- Hard Money Loan – For investors looking for a quick solution to commercial real estate financing may look to a hard money loan. Hard money lenders usually offer short-term loans at high interest rates, and evaluate the loan based on the perceived value of the property and not on the borrower’s credit history.

Some key takeaways to remember:

Commercial real estate loans are not always the easiest to secure and require more diligence, preparation and paperwork than most residential loans.

- Plan and prepare accordingly

- Understand the difference between residential and commercial loans

- Explore all of your available loan options

Interested in exploring what commercial property loan options lie ahead? Let’s talk!

We would be happy to discuss available options and decide on the best commercial property loan for you!