Going Through the Mortgage Process

Last Updated

May 5, 2020

Written by

First Family Credit Union

Step-by-Step Navigation Through the Mortgage Process

The loan process itself can seem like a confusing ritual but once you understand some of the terms, its not so intimidating. A good lender will walk you through the process, step by step.

If you take the time to understand the home buying process and come to it with a strong sense of your own finances, you can balance your way around the course without a scratch.

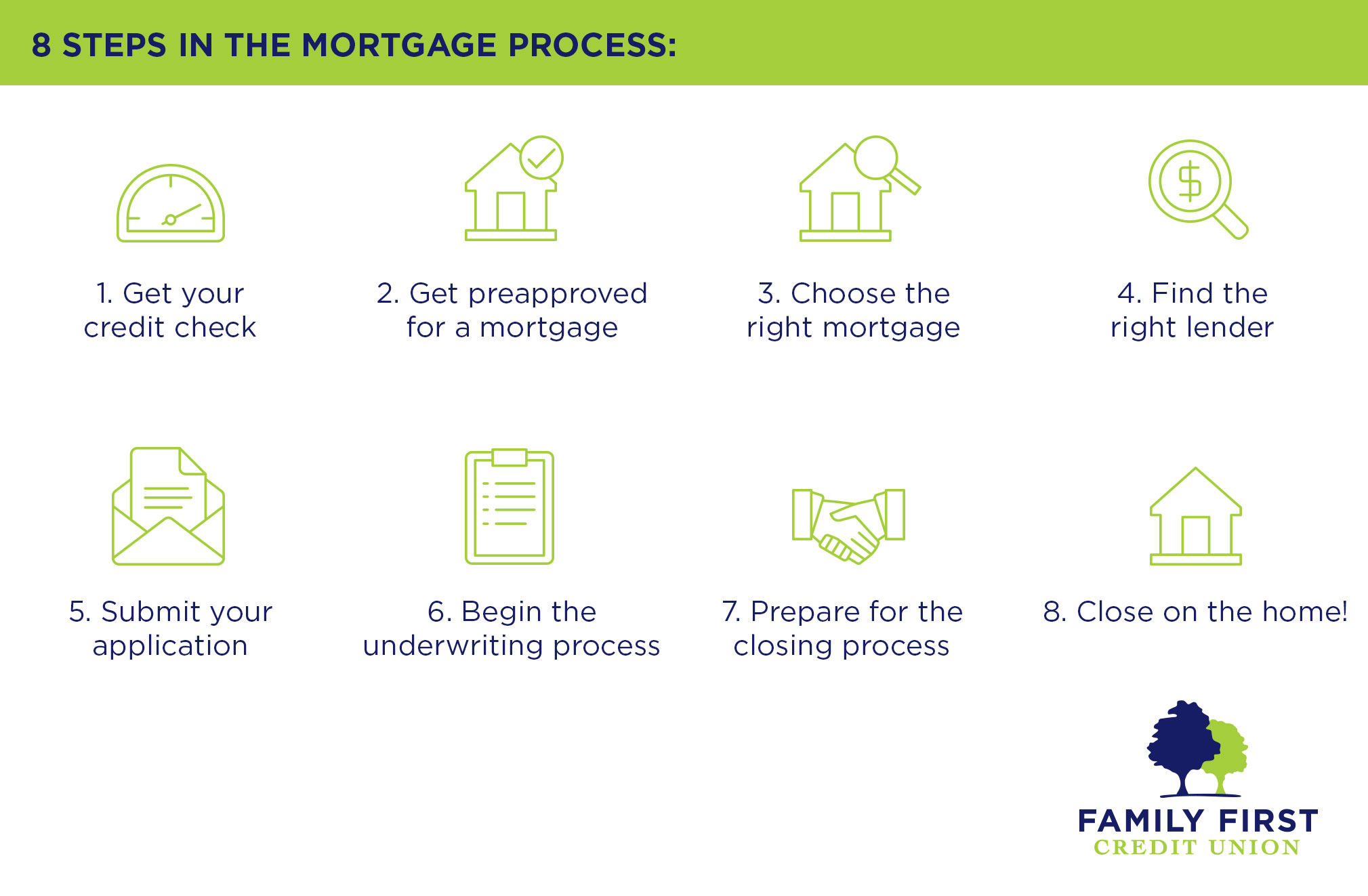

Here are the 8 Steps in the Mortgage Process:

Step #1: Get Your Credit in Check

Are you financially prepared for homeownership? Before you go further, ask yourself “how much can I afford?” Lenders looks carefully at your credit score, so check your score and take necessary steps to improve it such as lowering outstanding debt, disputing any errors, and holding off on applying for any other loans or credit cards.

Step #2: Get Preapproved

Getting preapproved for a mortgage will tell you how much the lender is comfortable letting you borrow for a home. Getting preapproved also gives you a leg up when looking at homes because it shows the seller that you can make a solid offer. You can get preapproved for a mortgage, now by speaking with one of our Family First mortgage experts.

Step #3: Choose the Right Mortgage

There are many mortgage and loan options out there. We recommend using a combination of an online mortgage calculator and speaking to a loan expert. That way, you can fully understand your financial position and what loan type is best for you. Some quick tips: know your APR, understand the mortgage term, and don’t borrow more than you can handle.

Step #4: Find the Right Lender

Find a lender that best suits you and someone that you can trust. If you already investigated some options before getting preapproved you’re one step ahead. If you’re just starting to look, consider using a broker, talk to your real estate agent, or ask friends and family for a recommendation. We’re happy to offer complimentary consultations with those interested in interviewing Family First as a lender. You can schedule a time to meet with us here or stop into one of our branches!

Step #5: Submit Your Application

Work with your selected lender to complete and submit your application. You’ll need to compile and submit your most recent financial information.

Step #6: Begin the Underwriting Process

This is the step where you officially get approved for the loan. During the underwriting process, the lender determines whether you’re eligible by reviewing credit history, job history, debt-to-income ratio, and current debt obligations.

During this process, we recommend you avoid making big changes in your financial status such as switching jobs, taking out another line of credit, or making big purchases.

Step #7: Prepare for the Closing Process

Congratulations! Your loan is approved. As you prepare for the closing process, there are a few things you should do:

- Purchase homeowners insurance

- Do a final walk through of the home

- Receive a closing disclosure three days before the scheduled closing date

- Get a cashier’s check to cover closing costs

Step #8: Close on the Home

You’re almost there! Typically you will pay between 2%-5% in closing costs along with private mortgage insurance if your down payment is less than 20% of the home’s purchase prices. To complete the process, you will have a closing meeting with some or all of the following parties:

- Your lender

- Your real estate agent

- Your attorney

- A title company representative

What’s Next?

Going through the mortgage process comes with a lot of paperwork and a lot of questions. Don’t be afraid to ask questions and take the time to understand it all! Now that you’re up to speed on the process, let us help you find the best mortgage rate for you.