Scams During COVID-19

Last Updated

June 26, 2020

Written By

First Family Credit Union

What Scams to Be on the Look Out for and How to Protect Yourself

During these unprecedented times, many are worried about protecting themselves from COVID-19 by practicing safe social distancing, proper hand-hygiene, and following the regulations provided by their state government. But how can you protect yourself from a new threat that has risen—fraudulent scams. According to the Federal Trade Commission, from January 1, 2020 to April 15, 2020, the FTC has received over 18,000 reports related to COVID-19 scams, and as a result it has been reported that people are losing $13.44 million dollars in total to fraud.

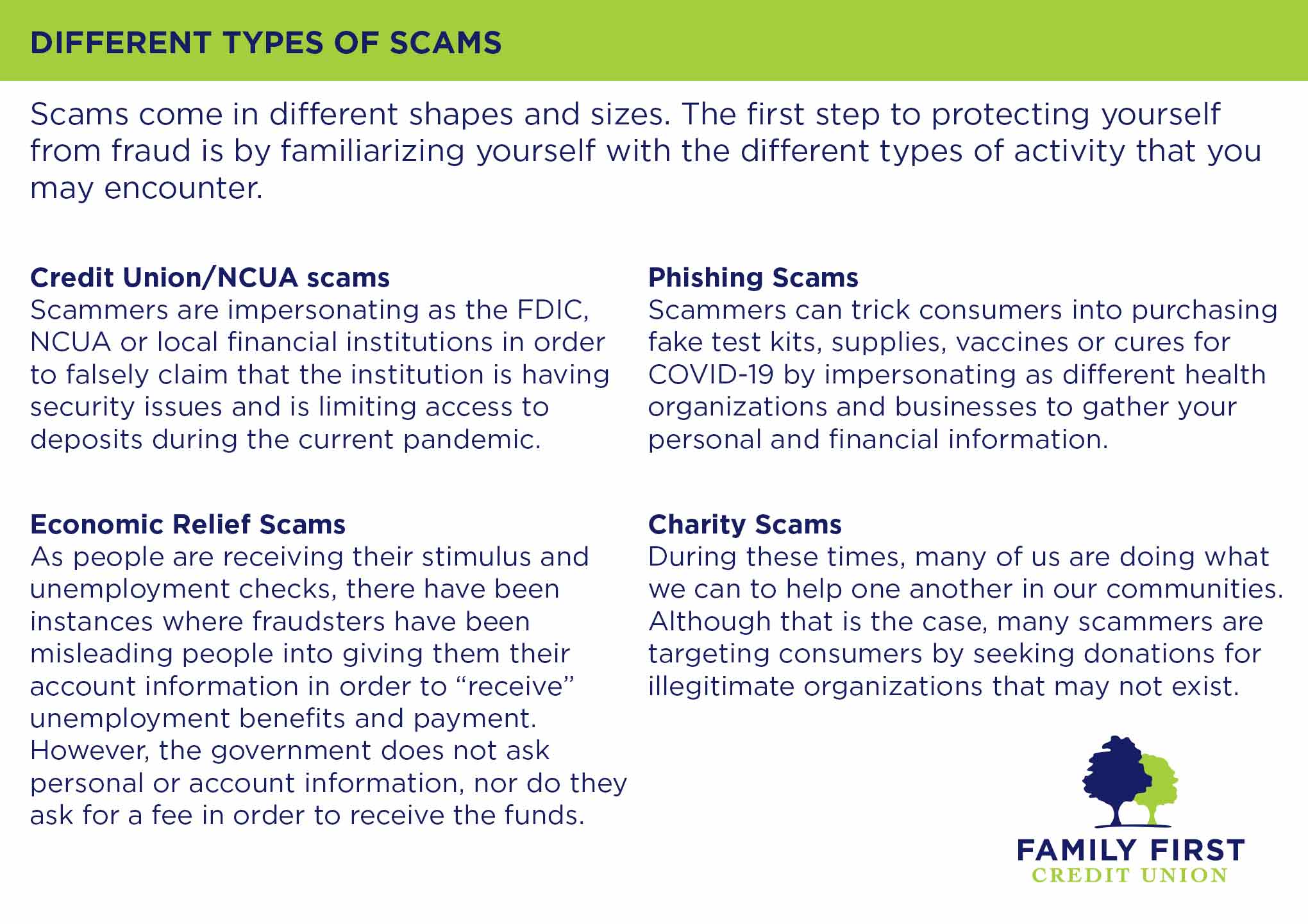

Different Types of Scams

Scams come in different shapes and sizes. The first step to protecting yourself from fraud is by familiarizing yourself with the different types of activity that you may encounter.

1. Credit Union/NCUA scams

Scammers are impersonating as the FDIC, NCUA or local financial institutions in order to falsely claim that the institution is having security issues and is limiting access to deposits during the current pandemic.

2. Phishing Scams

Scammers can trick consumers into purchasing fake test kits, supplies, vaccines or cures for COVID-19 by impersonating as different health organizations and businesses to gather your personal and financial information.

3. Economic Relief Scams

As people are receiving their stimulus and unemployment checks, there have been instances where fraudsters have been misleading people into giving them their account information in order to “receive” unemployment benefits and payment. However, the government does not ask personal or account information, nor do they ask for a fee in order to receive the funds.

4. Charity Scams

During these times, many of us are doing what we can to help one another in our communities. Although that is the case, many scammers are targeting consumers by seeking donations for illegitimate organizations that may not exist.

How Can I Protect My Finances?

Money is safest in a bank or credit union.

These institutions are secure and federally insured. When your finances are outside of the system, the level of protection decreases. Be sure to avoid giving companies or people that you are not familiar with your account and pin information.

Be wary of phishing scams

These types of scams use fake emails, phone calls, texts, and even website to mislead users to provide private login or account information. Avoid clicking on links and/or open attachments from sources that you are not familiar with. Recognize fake website links. For example, fraudulent link often has small changes to its URL.

Research charity organizations

Be sure to do some research before donating to a proclaimed organization. Take cautious measures if a business or charity is requesting COVID-19-related payments or cash donations through wire transfer, mail, or gift cards.

Secure your devices

While living in a digital world has its perks, one must be sure to secure all their devices. Having the latest software and operating system are the best ways to defend virus and other forms of malware. Be sure your laptop, phone, and other electronic devices are up-to-date at all times.

Secure your accounts with multi-factor authentication protocols by providing a phone number or security question.

Let’s Help One Another

Help others by reporting COVID-19-related scams. To provide information about suspected scams, visit www.ic3.gov. Stay up-to-date on the latest scams by visiting the Federal Trade Commission’s website at ftc.gov/coronavirus.

Let us help you keep your finances secure today!